Gran Chaco Soy Traceability: Challenges, Assessment, and the Role of Technology in Ensuring EUDR Compliance

- by

- mosaix_live

- July 29, 2025

Introduction

The Gran Chaco biome, spanning Argentina, Paraguay, and Bolivia, is South America’s second-largest forest region after the Amazon. Over the past decade, it lost approximately 6.2 million hectares of forest, largely due to soybean cultivation driven by global demand. This deforestation threatens biodiversity, including species such as the Jaguar, Chacoan Peccary, and Giant Anteater.

Soybean Cultivation Overview

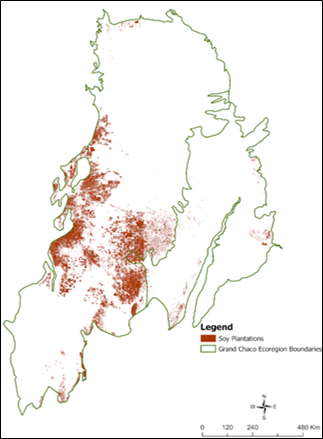

Currently, soybean plantations cover about 12.3 million hectares within the Gran Chaco (Figure 1). Argentina is the primary producer (12 million hectares), followed by Paraguay and Bolivia. Despite high plot registration rates (99%), concerns persist due to around 108,000 hectares of unregistered plots and 40,700 hectares overlapping protected areas and indigenous territories.

Figure 1: Distribution of Soy plantations Across the Gran Chaco Region

Figure 1: Distribution of Soy plantations Across the Gran Chaco Region

Deforestation Trends

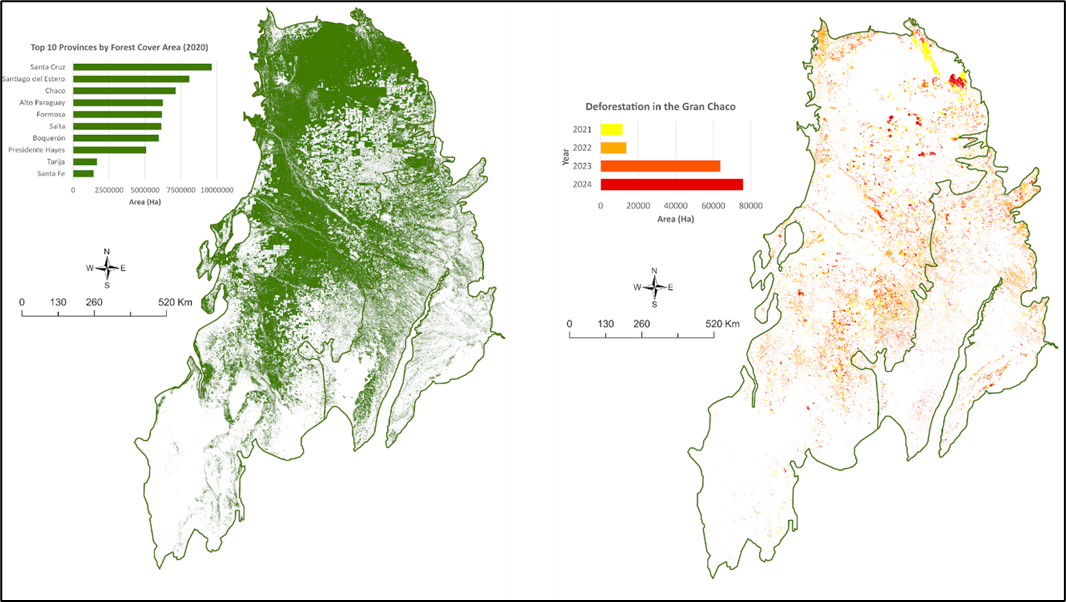

From 2015 to 2024, deforestation reached 6.2 million hectares, peaking in 2019 (Figure 2). Soybean expansion is the primary driver, especially in drier regions like the Dry Chaco. Provinces such as Santiago del Estero, Salta, and Chaco saw soybean cultivation surge dramatically (265%-791%) between 1996 and 2018. From 2021-2024, approximately 165,000 hectares were deforested for soy plantations (Figure 3).

Figure 2: Deforestation trend in Gran Chaco from 2015 – 2024

Figure 2: Deforestation trend in Gran Chaco from 2015 – 2024

Figure 3: Forest Cover 2020 (left) and Deforestation from 2021 to 2024 (right). The forest cover chart shows the top 10 provinces with the largest forest areas. The deforestation chart shows the total forest loss in soy plantation areas between 2021 and 2024

Figure 3: Forest Cover 2020 (left) and Deforestation from 2021 to 2024 (right). The forest cover chart shows the top 10 provinces with the largest forest areas. The deforestation chart shows the total forest loss in soy plantation areas between 2021 and 2024

Supply Chain Dynamics

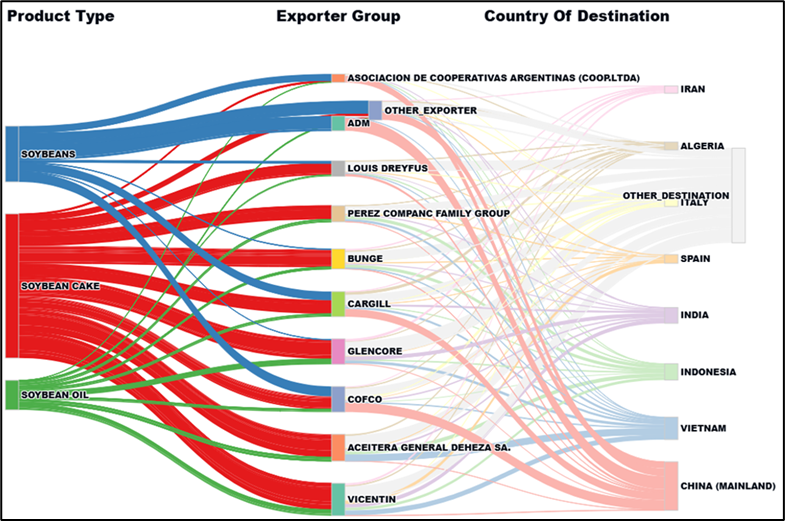

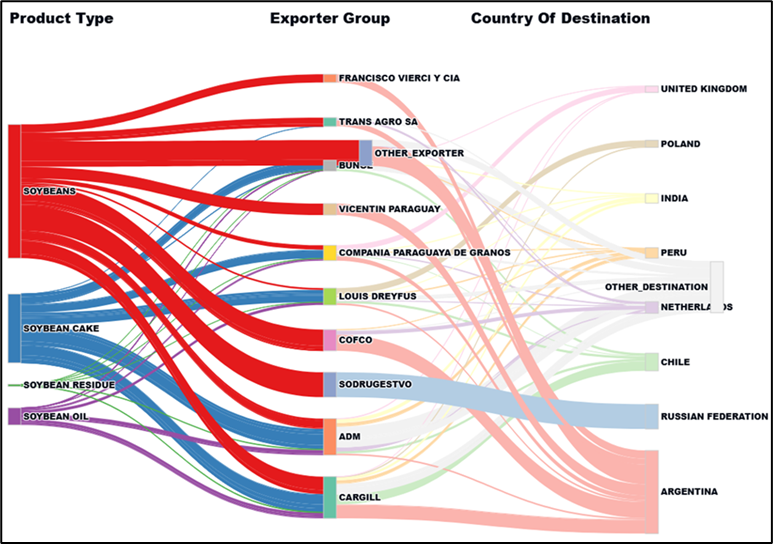

- Argentina: Dominates exports with 33.6 million tonnes of processed soy products and 13 million tonnes of raw soybeans primarily to China (Figure 4). Major exporters include Vicentin, Aceitera General Deheza, COFCO, Glencore, Cargill, and Bunge.

Figure 4: Soy Product Export Flows from Argentina Categorized by Exporter Group and Destination Country

Figure 4: Soy Product Export Flows from Argentina Categorized by Exporter Group and Destination Country

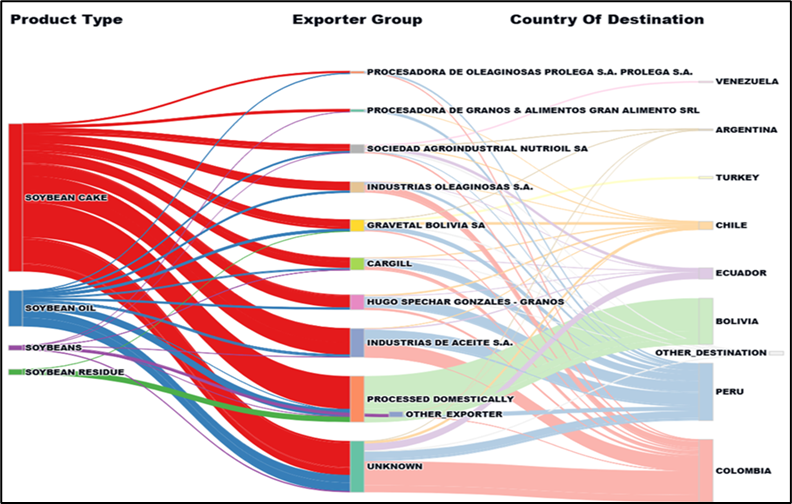

- Paraguay: Middle-scale exporter with significant regional and global reach, exporting 4.4 million tonnes of raw soybeans (Figure 5).

Figure 5: Soy Product Export Flows from Bolivia Categorized by Exporter Group and Destination Country

Figure 5: Soy Product Export Flows from Bolivia Categorized by Exporter Group and Destination Country

- Bolivia: Smaller scale, focusing on regional markets with limited global exports (Figure 6).

Figure 6: Soy Product Export Flows from Paraguay Categorized by Exporter Group and Destination Country

Figure 6: Soy Product Export Flows from Paraguay Categorized by Exporter Group and Destination Country

Multinational companies ADM, Cargill, COFCO, Louis Dreyfus, and Bunge are significant players in all three countries.

Compliance with EU Deforestation Regulation (EUDR)

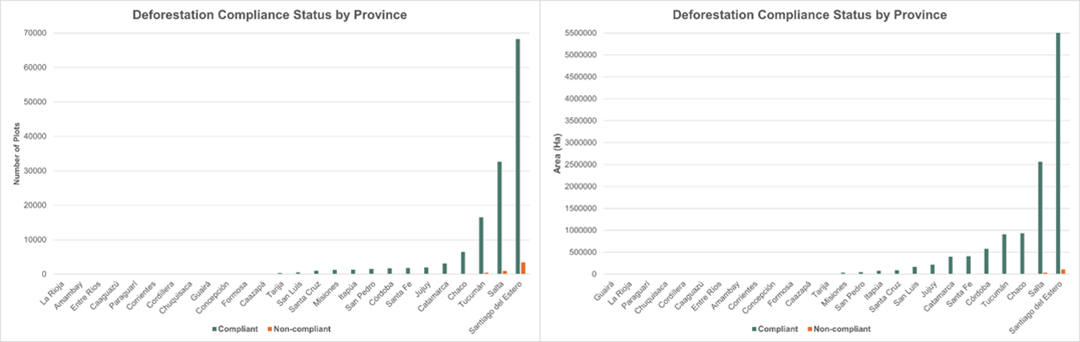

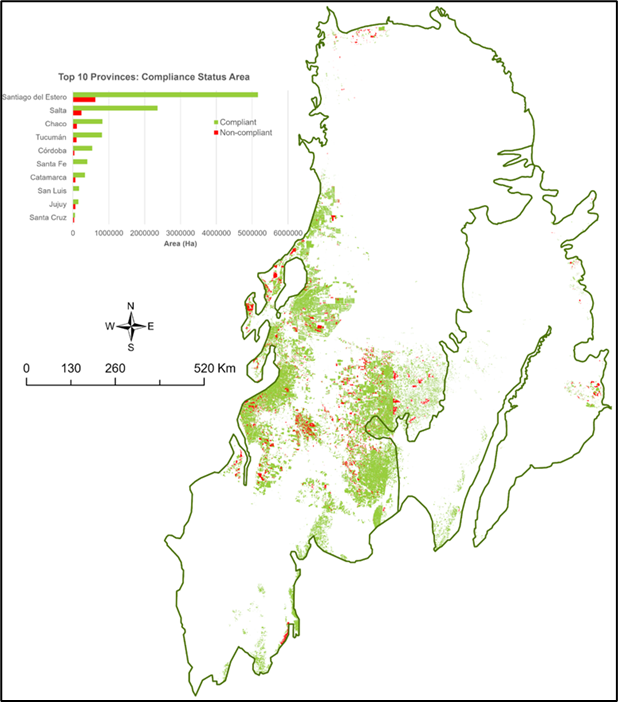

About 96% of soybean plots meet EUDR compliance (no deforestation post-2020, proper registration, and outside protected areas). Approximately 4% (5,438 plots) are non-compliant due to recent deforestation, posing legal and reputational risks (Figure 7 and Figure 8).

Figure 7: Deforestation compliance status by number of plots (left) and by area (right) in each province.

Figure 7: Deforestation compliance status by number of plots (left) and by area (right) in each province.

Figure 8: EUDR Compliance Status of Soy Plots in Gran Chaco. The compliance status chart shows the top 10 provinces with the largest areas of compliant soy plots.

Figure 8: EUDR Compliance Status of Soy Plots in Gran Chaco. The compliance status chart shows the top 10 provinces with the largest areas of compliant soy plots.

Key Compliance Challenges

- Plot-Level Traceability: Difficulty obtaining precise geolocation data.

- Monitoring Deforestation: Need for robust satellite and geospatial monitoring.

- Legal Compliance: Diverse legal frameworks complicate verification processes.

- Data Integration and Reporting: Requires sophisticated systems for efficient due diligence reporting.

Technological Solution: Agriplot Due Diligence System (DDS)

Agriplot DDS enhances compliance through:

- Accurate geolocation of soybean plots

- Real-time tracing from farm to port

- Automated deforestation and compliance checks

- Standardized due diligence reports aligned with EUDR

Currently, Agriplot DDS monitors 51.1 million hectares in Latin America and tracks over 100 soy-related facilities, offering significant strategic value for global supply chain compliance.

Conclusion

Ensuring soybean supply chains in Gran Chaco are sustainable and compliant with EUDR is crucial. Enhanced technological solutions like Agriplot DDS, combined with proactive monitoring and enforcement, will help protect the region’s biodiversity while supporting global agricultural demand sustainably.

Read the complete article here.

MosaiX Article

MosaiX Article